40+ federal tax mortgage interest deduction

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

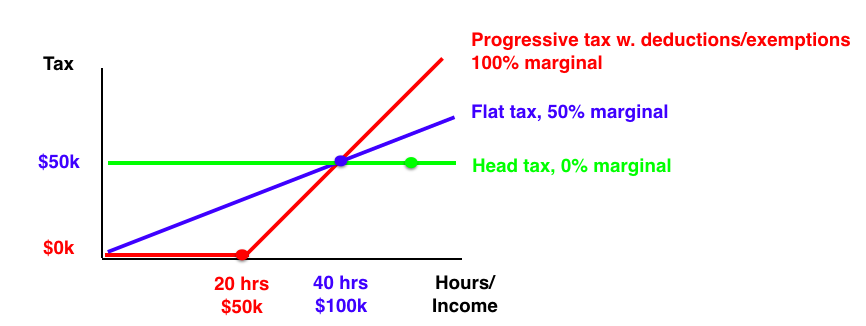

Tax Graph Seeking Alpha

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

. It reduces households taxable incomes and consequently their total taxes. Web March 4 2022 439 pm ET. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Enter your mortgage interest costs on lines 8 through 8c of Schedule A then transfer the. Single or married filing separately 12550 Married filing jointly or qualifying widow er.

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Homeowners who are married but filing. For married taxpayers filing separate returns the cap.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web Enter your address and answer a few questions to get started. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

If your home was purchased before Dec. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Ad Contribute to an IRA by 418 and potentially lower your income taxes.

Web For 2021 tax returns the government has raised the standard deduction to. Web In this example you divide the loan limit 750000 by the balance of your mortgage. TaxInterest is the standard that helps you calculate the correct amounts.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web The interest you pay each year can be deductible on your US. Limiting the home mortgage.

Federal tax return but only if you meet certain requirements. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. This deduction is capped at 10000 Zimmelman says.

The interest on an additional. Web Mortgage interest deduction limit. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Start saving for the retirement you envision. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Your mortgage lender should send. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. So if you were dutifully. Web The word tax appears 97 times and counting in one recent summary of governors addresses to state legislators so far this year.

However higher limitations 1 million 500000 if married. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Explore contribution limits for 2022 taxes.

Web To claim the mortgage interest deduction a taxpayer should use Schedule A which is part of the standard IRS 1040 tax form. Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. The policy visions that.

Its important to note that you cant deduct the amount. Homeowners who bought houses before. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

Web Each year when you fill out your federal income tax return you can either take the standard deduction or itemize deductions.

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

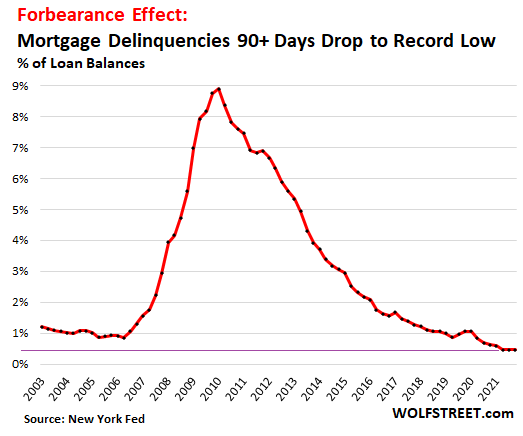

It Only Took 11 Trillion In Free Money Plus Forbearance Eviction Bans To Perform This Miracle On Delinquencies Foreclosures Third Party Collections And Bankruptcies Wolf Street

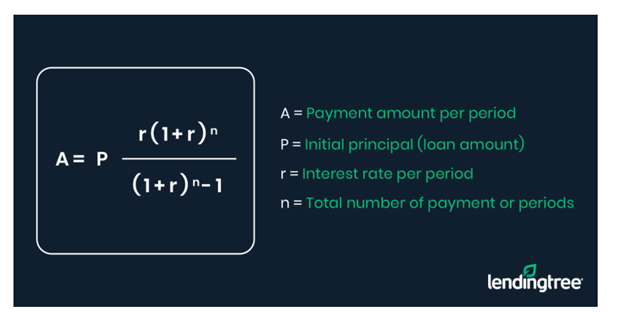

The Home Mortgage Interest Deduction Lendingtree

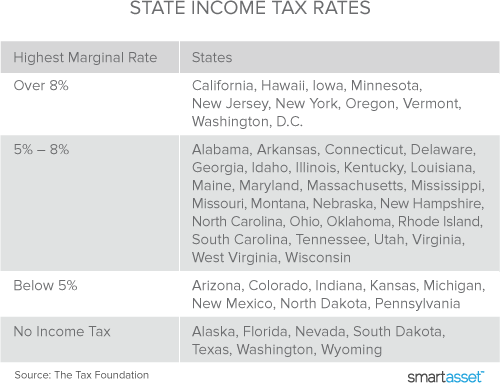

Mortgage Interest Tax Deduction Smartasset Com

15 Vs 30 Year Mortgage In An Infographic

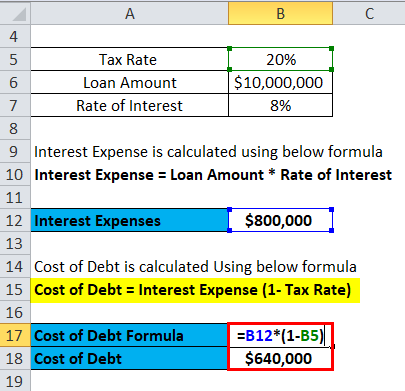

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

Mortgage Interest Deduction Bankrate

Cost Of Debt Formula How To Calculate It With Examples

Mortgage Tax Deduction Calculator Homesite Mortgage

Mortgage Interest Deduction Bankrate

Interest Income How To Calculate Interest Income With Example

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

Maximising Property Tax Deductions For The 2020 21

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be